Insurance

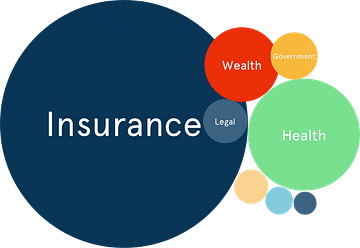

Hyper-connected industries dynamically converging

to meet human needs

Personalized insurance policies for today’s information hyper generation; AI is enabling ‘smart liability profiling’ of consumers with data collected from sources like health sensors, automobile sensors / telematics systems, smart home sensors informing high levels of personalization.

Digital savvy millennial consumers prefer simple, personalised policies, transparent processes and services that are just clicks away – accessible from the convenience of their smart phones and manageable with virtual assistance than requiring physical movement or manual work. Semi automated claims & settlement processing using Blockchain, for example – could bring in radical transparency and faster help to genuine victims / survivors in need of help. This requires traditional insurance companies to transition from being a policy-centric business to a customer-centric, digital-first business.

Research shows that about 23% of consumers struggle to clearly understand insurance policies and as a result they lack trust on the insurance provider / agent / broker because of hidden agenda / intent / focus on making an immediate sale, than creating value. Also, 47% of insurance holders feel frustrated with the paperwork, 39% find the policies not completely addressing their needs, 35% have faced issues during claim processing.

More data you can have of the modern day consumer – by gathering the right behavioral signals can help insurance policy providers to deeply personalize the insurance cover and the premium tailored to meet the needs of that individual. AI powered Intelligent sensing technologies and predictive analytics capabilities when integrated with the legacy business intelligence systems in the right way could potentially address some of the most pressing pain-points of insurance holders and providers.

Our offerings for Our offerings for insurance sector:

- Personalised policy management & administration software development

- Digitization of insurance policy issuance and claims processes

- AI/MLled digitization of claims and settlements

- Digitized, secure processes to automate legal & regulatory compliances

- Automation of fraud detection & prevention solutions (blockchain)

- Integrated telematics based insurance software system development

- Exposure management software for Insurance companies

- Insurance applications for agents / brokers / policy sellers

- Peer-to-peer insurance app development services

- Data analytics for Insurance companies / providers

- End-to-end Insurance services software

We start with thoroughly understanding your business needs, assessing your existing technological infrastructure and accordingly design a digital / data strategy for you to meet your critical organizational goals – both short and long term.

Today, your digital strategy could involve participation and integration of multiple industries and cross-pollination of ideas and offerings.

There’s high levels of integration, collaboration and interoperability made possible with technologies like Blockchain. Also, fluctuation in demand for one industry could impact others. For example, rising demand for food delivery at the door, increased the demand for 2-wheeler transport to solve the ‘last-mile-connectivity’ problem and the demand for fractional ownership of bikes.

Multi-industry collaborations or cross-domain integrations are becoming the new norm, to thrive in today’s “Intelligence first” era, businesses need to embrace this change and exploit advanced digital technologies to participate in consistently delivering maximum consumer value.

Frequently asked questions

Depending on the type of insurance app you are building the insurance app development approach would vary (slightly). Normally, we take data & design thinking led, regulatory-compliance focused agile development approach to build & launch your insurance app.

Insurance in India is either general insurance or life insurance.

General has health, motor, fire, travel, and home insurance.

Life insurance has term plans, child plans, pension plans, endowment plans, and lifetime plans.

In United States, there are two major categories:

1. Life, Health is unified into one group covering dental, vision, medication, accidents, hospital indemnity, disablement, long-term care, annuities (securities), etcetera;

2. Property and casualty is another category covering flood, earthhquake, fire, worker’s compensation, pet related risks.

Are you planning to develop insurance apps like Oscar, Clover health, Bright health, Next insurance, Amwell, Hippo insurance, Gusto, Root insurance, Lemonade, Carecloud, Policygenius, Policybazaar, Digit insurance, Acko etc.,?

Yes?

Well, the insurance app development cost will depend on the technologies you use and where you outsource it from.

Normally, insurance app development will cost around $60,000 to %150,000.

Again. pricing totally depends on the complexity of the app you are planning to build.

P2P insurance, on demand insurance; drone verification; blockchain based auto insurance claims; data, AI & ML powered personalisation, and edge powered behavior based insurance are some of the top insurTech trends.

Legacy insurance providers and insurers are slowly upgrading their tech now to deliver insurance remotely over the cloud.

Transparency is also a core focus area, and so blockchain adoption is a rising insurance trend for insurers across the world.

Admin panel, policy information, plans, filters, insurance claims, premiums & payment integration, customer support, push notification, KYC & document uploading features, insurance agent portal, dashboard, and unified insurance analytics, shared family insurance insights, insurance recommendations, and alerts are some of the must haves for the insurance app. As discussed in the first question, the types of insurance app you are building will dictate the feature requirements list for your insurTech app.